As an experienced IELTS instructor, I’m excited to share with you a comprehensive reading practice focused on the innovative topic of blockchain technology and its impact on financial inclusion. This practice will help you prepare for the IELTS Reading section while exploring an important subject in today’s digital economy.

Nội dung bài viết

Blockchain and Financial Inclusion

Blockchain and Financial Inclusion

Introduction

The IELTS Reading section tests your ability to understand complex texts and answer various question types. Today, we’ll explore how blockchain technology is revolutionizing financial inclusion through a series of passages and questions that mirror the actual IELTS exam format.

Reading Passages and Questions

Passage 1 (Easy Text)

Blockchain: A New Era of Financial Inclusion

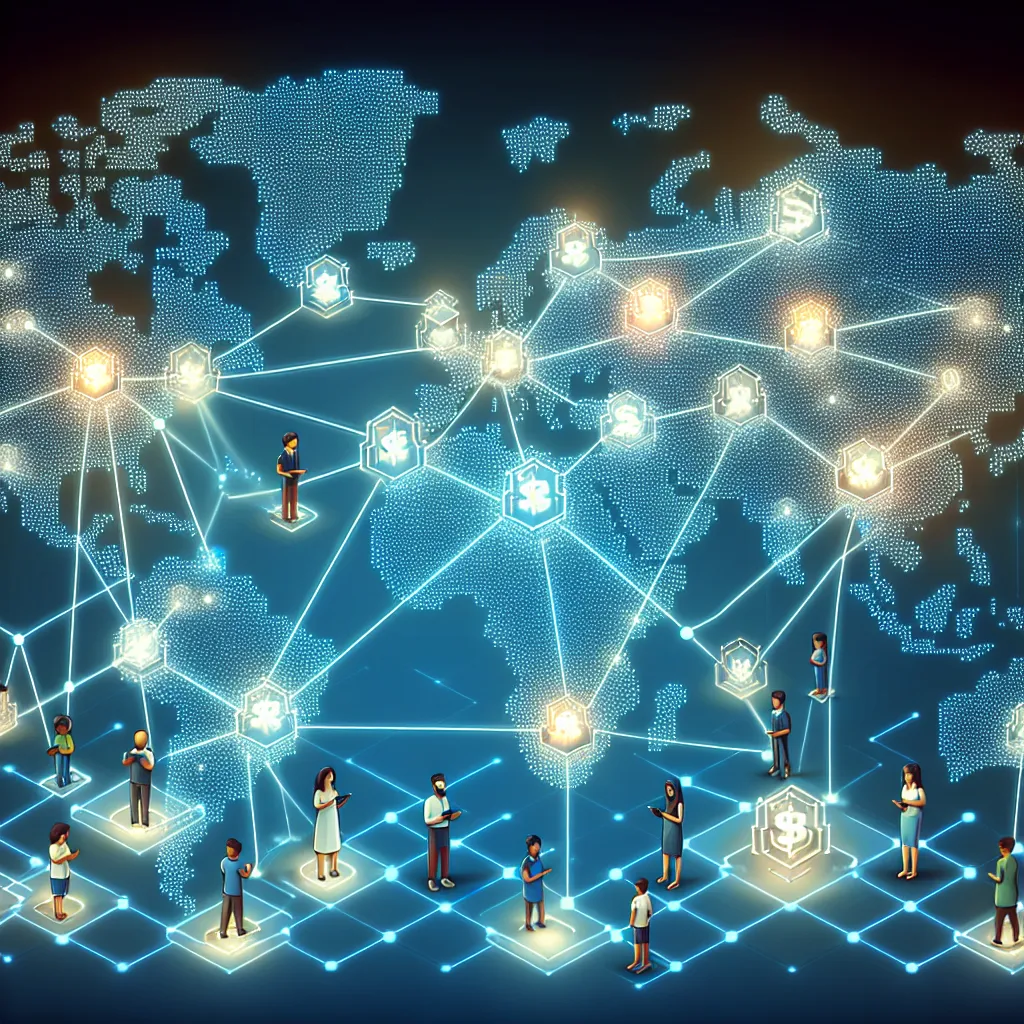

Blockchain technology, originally developed as the foundation for cryptocurrencies like Bitcoin, has emerged as a powerful tool for promoting financial inclusion worldwide. This decentralized digital ledger system offers a secure and transparent way to record transactions, making it particularly valuable in regions where traditional banking infrastructure is limited or unreliable.

One of the most significant advantages of blockchain is its ability to provide financial services to the unbanked and underbanked populations. In many developing countries, a large percentage of adults lack access to basic banking services, such as savings accounts or credit facilities. Blockchain-based solutions can bypass the need for physical bank branches, allowing individuals to access financial services through their mobile phones or other digital devices.

Moreover, blockchain technology can significantly reduce the costs associated with financial transactions, particularly for cross-border remittances. Traditional money transfer services often charge high fees and can take several days to process international payments. Blockchain-powered systems can facilitate near-instantaneous transfers at a fraction of the cost, making it easier and more affordable for migrant workers to send money back to their families in their home countries.

Questions 1-5: True/False/Not Given

For each statement, write:

TRUE if the statement agrees with the information in the passage

FALSE if the statement contradicts the information in the passage

NOT GIVEN if there is no information about the statement in the passage

- Blockchain technology was initially created for cryptocurrencies like Bitcoin.

- Traditional banking infrastructure is widely available in all regions of the world.

- Blockchain can provide financial services to people without bank accounts.

- Blockchain-based solutions require users to visit physical bank branches.

- Blockchain technology can make international money transfers faster and cheaper.

Questions 6-10: Matching Information

Match the following phrases (A-E) with the correct information from the passage (6-10).

A. Decentralized digital ledger

B. Unbanked and underbanked populations

C. Cross-border remittances

D. Mobile phones

E. Traditional money transfer services

- A system used to securely record transactions in blockchain technology

- Groups of people who lack access to basic banking services

- Devices that can be used to access blockchain-based financial services

- International payments that can benefit from blockchain technology

- Financial services that often charge high fees for international transfers

Passage 2 (Medium Text)

Blockchain’s Impact on Microfinance and Small Business Lending

The integration of blockchain technology into microfinance and small business lending is transforming the landscape of financial inclusion in developing economies. Traditional microfinance institutions (MFIs) have long played a crucial role in providing small loans to entrepreneurs and individuals who lack access to conventional banking services. However, these institutions often struggle with high operational costs, limited reach, and difficulties in assessing borrower creditworthiness.

Blockchain technology offers innovative solutions to these challenges. By leveraging smart contracts and distributed ledger technology, blockchain-based microfinance platforms can automate many of the processes involved in loan origination, disbursement, and repayment. This automation significantly reduces operational costs, allowing MFIs to offer more competitive interest rates and reach a broader customer base.

Furthermore, blockchain’s immutable and transparent nature provides a more reliable way to track borrowers’ financial histories. This enhanced credit scoring capability enables lenders to make more informed decisions about loan approvals and terms, potentially expanding access to credit for individuals and small businesses that would otherwise be considered too risky by traditional financial institutions.

Another significant advantage of blockchain in microfinance is its ability to facilitate peer-to-peer lending platforms. These platforms connect individual lenders directly with borrowers, bypassing traditional financial intermediaries. This disintermediation can result in lower interest rates for borrowers and higher returns for lenders, creating a more efficient and inclusive financial ecosystem.

Questions 11-14: Multiple Choice

Choose the correct letter, A, B, C, or D.

-

According to the passage, traditional microfinance institutions face challenges with:

A. High interest rates

B. Excessive profits

C. High operational costs

D. Too many borrowers -

Blockchain technology can help microfinance institutions by:

A. Increasing the need for physical branches

B. Automating loan processes

C. Eliminating the need for loans

D. Raising interest rates -

Enhanced credit scoring through blockchain can:

A. Limit access to credit

B. Increase loan defaults

C. Improve loan approval decisions

D. Eliminate the need for credit checks -

Peer-to-peer lending platforms enabled by blockchain can:

A. Increase the role of financial intermediaries

B. Result in higher interest rates for borrowers

C. Reduce returns for lenders

D. Create a more efficient financial ecosystem

Questions 15-18: Sentence Completion

Complete the sentences below using NO MORE THAN TWO WORDS from the passage for each answer.

- Blockchain technology uses ____ ____ to automate microfinance processes.

- The ____ ____ of blockchain provides a reliable way to track financial histories.

- Improved credit scoring capabilities allow lenders to make more ____ ____ about loans.

- Blockchain facilitates ____ ____ platforms that connect lenders and borrowers directly.

Passage 3 (Hard Text)

The Synergy of Blockchain and Digital Identity for Financial Inclusion

The confluence of blockchain technology and digital identity solutions presents a paradigm shift in addressing one of the most persistent barriers to financial inclusion: the lack of verifiable identity documentation. In many developing countries, a significant portion of the population lacks official identification, which is often a prerequisite for accessing formal financial services. This identity gap not only excludes individuals from the financial system but also poses challenges for financial institutions in terms of compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

Blockchain-based digital identity systems offer a promising solution to this conundrum. By leveraging the immutability and decentralized nature of blockchain, these systems can create secure, portable, and user-controlled digital identities. Unlike traditional centralized identity systems, which are vulnerable to data breaches and unauthorized access, blockchain-based identities are cryptographically secure and can be verified without relying on a single central authority.

The implementation of such digital identity solutions can have far-reaching implications for financial inclusion. For instance, individuals can use their blockchain-based digital identities to open bank accounts, apply for loans, or access other financial services without the need for physical documentation. This is particularly beneficial for refugees, migrant workers, and other vulnerable populations who may have lost their physical identification documents or never had them in the first place.

Moreover, the interoperability of blockchain-based identity systems can facilitate seamless access to financial services across borders. As these digital identities are not tied to a specific country or institution, they can potentially enable individuals to access financial services globally, fostering greater financial inclusion on an international scale.

The integration of blockchain-based digital identities with other emerging technologies, such as biometrics and artificial intelligence, further enhances their potential for financial inclusion. Biometric authentication can provide an additional layer of security and convenience, while AI algorithms can analyze identity data to assess creditworthiness more accurately, potentially expanding access to credit for underserved populations.

However, the adoption of blockchain-based digital identity systems for financial inclusion is not without challenges. Issues such as scalability, privacy concerns, and the need for regulatory frameworks must be addressed. Additionally, ensuring digital literacy and access to necessary technology among underserved populations remains a crucial consideration in the effective implementation of these solutions.

Questions 19-23: Matching Headings

Match the following headings (A-G) with the correct paragraphs (19-23).

A. Challenges in Implementing Blockchain-Based Digital Identities

B. The Problem of Identity in Financial Inclusion

C. Blockchain and Digital Identity: A Solution to the Identity Gap

D. Global Financial Access Through Interoperable Digital Identities

E. Enhancing Digital Identities with Complementary Technologies

F. Traditional Identity Systems vs. Blockchain-Based Solutions

G. The Impact of Digital Identities on Vulnerable Populations

- Paragraph 1

- Paragraph 2

- Paragraph 3

- Paragraph 4

- Paragraph 5

Questions 24-26: Summary Completion

Complete the summary below using NO MORE THAN TWO WORDS from the passage for each answer.

Blockchain-based digital identity systems offer a solution to the problem of financial exclusion caused by lack of identification. These systems create (24) ____ ____ digital identities that are more secure than traditional centralized systems. This technology is particularly beneficial for (25) ____ and ____, who may lack physical documentation. The (26) ____ of these identity systems allows for potential global access to financial services.

Questions 27-30: Short Answer Questions

Answer the following questions using NO MORE THAN THREE WORDS from the passage for each answer.

- What two regulations pose challenges for financial institutions when dealing with individuals lacking official identification?

- What characteristic of blockchain ensures that digital identities cannot be altered once created?

- Which two emerging technologies can be integrated with blockchain-based digital identities to enhance their effectiveness?

- What skill is crucial for underserved populations to effectively use blockchain-based digital identity solutions?

Answer Keys

Passage 1

-

TRUE

-

FALSE

-

TRUE

-

FALSE

-

TRUE

-

A

-

B

-

D

-

C

-

E

Passage 2

-

C

-

B

-

C

-

D

-

smart contracts

-

immutable nature

-

informed decisions

-

peer-to-peer

Passage 3

-

B

-

C

-

G

-

D

-

E

-

secure portable

-

refugees migrant workers

-

interoperability

-

KYC and AML

-

immutability

-

biometrics artificial intelligence

-

digital literacy

This IELTS Reading practice set explores the fascinating intersection of blockchain technology and financial inclusion. By working through these passages and questions, you’ve not only enhanced your reading comprehension skills but also gained valuable insights into how innovative technologies are reshaping the global financial landscape.

Remember, success in the IELTS Reading section comes from regular practice and familiarity with various question types. Keep honing your skills, and you’ll be well-prepared for the actual exam. For more IELTS preparation resources and tips, check out our articles on the future of cryptocurrency in the financial sector and how fintech is reshaping the global financial landscape.

Good luck with your IELTS preparation!